Research Areas and Interests

Accessible Quantitative Investing

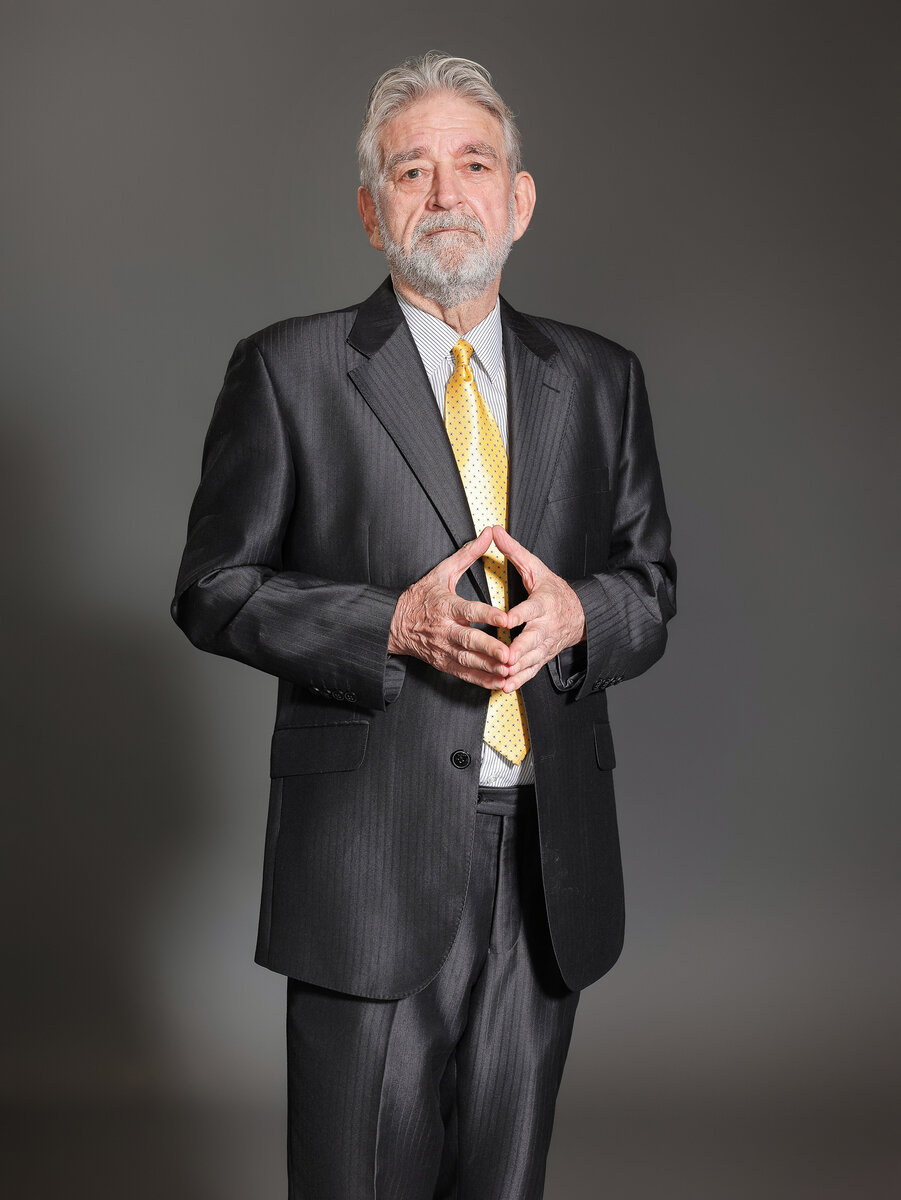

Roland Haverford focuses on building calm, rules-based investment approaches that everyday investors can actually live with. His work emphasizes systematic processes over market drama, offering frameworks that reduce noise, anchor expectations, and turn quantitative thinking into something practical instead of intimidating.

Systematic Multi-Market Strategies

At EraMix Financial Union, he develops quantitative toolkits that span stocks, futures, foreign exchange, and digital assets. The focus is on diversified rule sets, statistical edge, and repeatable execution routines that seek to balance risk and return across many trades rather than single, high-stress bets.

Education, Risk Discipline, and Automation

Haverford’s research links investor education with automation and risk controls. He explores how pre-defined rules, strict stop logic, and process-driven alerts can steady decision-making, helping learners move from gut feeling to structured routines while still retaining informed control over their capital.